Real estate is one of the most common investment sectors in Spain. This is because investing in real estate offers numerous advantages compared to other types of investment products.

Advantages of investing in real estate

However, it is essential to acknowledge that, like any investment, real estate carries risks. Property values can decline, as seen during crises like the one in 2008.

Housing Prices in Spain

The price of residential property sales in Spain is experiencing an unstoppable upward trend. Prices have been increasing for months, with the last negative figure dating back to 2021.

The annual variation in Madrid reached 17.8% in September 2024, according to Idealista, marking an all-time high. Prices are also at record levels in Barcelona, with a 9.8% increase, and in Valencia, where the average price exceeds €2,700 per square meter.

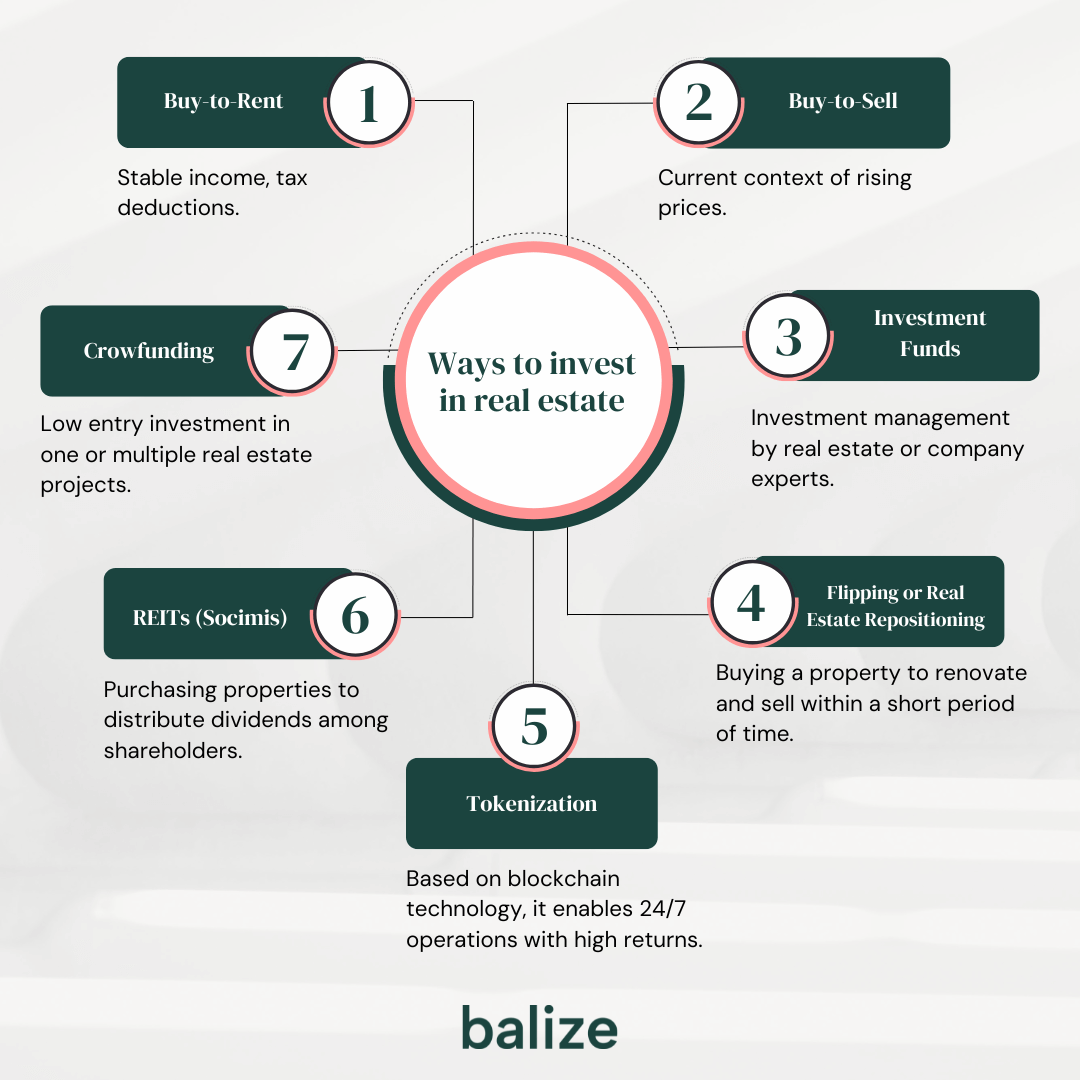

Different ways to invest in real estate

Buy-to-Rent

This option provides a stable and long-term income stream for the owner. To assess profitability, it is important to consider initial costs, maintenance expenses, and the periods the property may remain vacant.

In this regard, it is worth noting that long-term residential rentals offer tax deductions on income tax filings, ranging from 50% to 90%, provided certain requirements are met.

The rental market is also on the rise. Demand has increased significantly due to the difficulty of purchasing property, driven by high interest rates and reduced bank financing.

Buy-to-Sell

In the current upward trend of high property prices, purchasing a property and waiting to sell it also presents an opportunity. In this case, it is essential to carefully calculate the associated expenses and taxes.

Flipping or real estate repositioning

Buying a property to renovate and then sell it within a short period is another opportunity to consider, provided a thorough analysis of the asset is conducted.

Investment Funds

Managed by experts, these funds invest in rental assets or companies within the sector.

REITs (Socimis)

Real Estate Investment Trusts (Sociedades Cotizadas Anónimas de Inversión en el Mercado Inmobiliario) aim to purchase properties and distribute around 80% of their dividends to shareholders.

Crowdfunding

Platforms allow numerous small investors to participate in one or multiple real estate projects, providing returns based on the amount contributed.

Tokenization

Real estate tokenization is an innovative investment alternative based on blockchain technology, enabling secure and transparent transaction recording.

Why choose real estate investment?

Investing in real estate not only offers a wide range of options to suit different profiles and budgets but also provides stability, security, and profitability opportunities. Whether through traditional approaches like rental income or innovative alternatives such as tokenization, the real estate market remains a solid choice for those looking to diversify their wealth.

At balize, we make accessing this world of opportunities easier by combining technological innovation with traditional strategies to maximize the value of your investment. With an affordable entry ticket and operations managed transparently, we take a step into the future of real estate investment.