Real estate investment has historically been one of the safest and most profitable alternatives. However, the traditional real estate sector presents a series of limitations and challenges that make access to this form of investment more complicated than it appears.

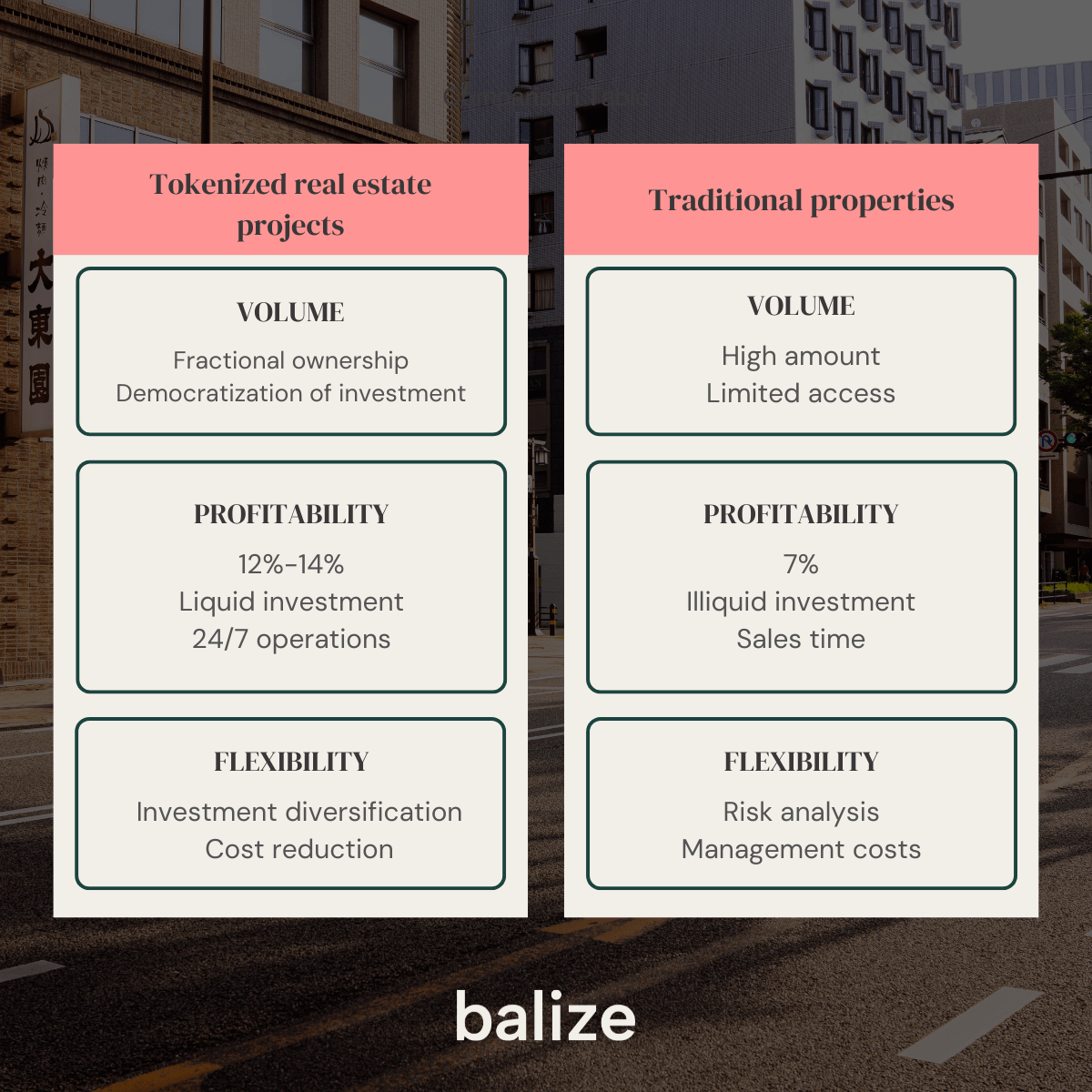

Key differences between investing in tokenized real estate and traditional real estate

The advent of blockchain technology and asset tokenization is introducing new investment opportunities in the real estate market as well. In this article, we outline the key differences between traditional real estate investment and investing in properties through tokens.

First of all, it’s important to specify that the tokenization of real estate investments involves the digital representation of an investment in a real estate asset. The property itself or the ownership rights to the asset are not tokenized; rather, the financial instrument is tokenized, not the collateral that determines its profitability. This is the case because, in Spain, the law requires the registration of the property in the Land Registry to protect the owner's rights.

Investment volume

First of all, it’s important to note that traditional real estate investment requires a considerably high amount of capital, which significantly limits access to this type of investment for a large number of people.

In contrast, the tokenization of real estate investments allows for fractional ownership, meaning that smaller amounts of money can be invested across various assets. The entry ticket for real estate investment through tokens can be much lower, with balize offering entry from as little as 10,000 euros.

Real estate investment profitability

In most cases, the process of purchasing real estate is lengthy and complex. Investors need to search, compare, negotiate, and close the deal with the seller. It is also necessary to conduct an analysis of the asset and the market to ensure that the investment will be profitable.

Real estate investments typically do not provide short- or medium-term returns. According to data from the first quarter of 2024, the Bank of Spain estimates a gross rental yield of 3.4%, which can reach 7% when considering both rental income and price variation.

Additionally, traditional real estate investment does not offer much liquidity. This means that investors cannot easily and quickly sell the property and recover their investment. The average time to sell a property largely depends on its location. For example, a home in major cities like Madrid or Málaga may stay on the market for about 12 weeks, whereas in Palencia, it could take around 32 weeks to find a buyer, according to GSRAW data. Furthermore, there may be difficulties in finding buyers willing to pay the asking price.

Thanks to blockchain technology, the tokenization of real estate projects offers greater liquidity. Tokens can be traded at any time on a secondary market that operates 24/7 across Europe, or they can be transferred to another user almost instantly. This means that investors can recover their contributions more quickly. Regarding profitability, it varies greatly depending on the type of project, but returns of 12% to 14% are achievable.

Flexibility and Cost Reduction in Real Estate Investment

The tokenization of real estate projects offers greater flexibility in terms of portfolio diversification. At balize, investors can visit the projects section on our website and invest in properties located in different locations with varying returns. This allows investors to achieve greater diversification and reduce risk in their investments.

Blockchain technology and real estate asset tokenization: New opportunities for small investors

For all these reasons, the tokenization of real estate projects offers numerous advantages over traditional investment.

Most of balize's projects are residential, although we have also incorporated flip proposals in premium locations, as well as coliving and coworking spaces.

We develop each project for short- to medium-term sales, generating returns for both users and the platform. Our vision is to simplify and democratize access to a sector characterized by complex bureaucratic processes that traditionally require large investments.